nassau county property tax rate 2020

Interest rates on court-ordered property tax refunds. Cities Towns and Villages A-Z.

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

A Senior Exemption provides.

. Tax description Assessed value Tax rate Tax amount. The Tax Collector collects all ad valorem taxes levied in Polk County. Standards for electronic real property tax administration.

Property tax and assessment news. Interest rate on late payment of property taxes. Notice that we use old 2020 tax rates.

- a full value FV county tax rate by dividing the county tax levy county general tax levy plus county district levies with adjustments. Legal memos papers and miscellaneous laws. Nassau County that meet income or economic harm requirements.

Most senior homeowners are eligible for this exemption if they are 65 years of age or older and own and occupy their property as their principal place of residence. HEALTH DEPARTMENT PROGRAMS AND TELEPHONE NUMBERS. - a full value FV county tax rate by dividing the county tax levy county general tax levy plus county district levies with adjustments.

The Tax Collector also collects non-ad valorem assessments which are. Local laws and resolutions. Using 2020 income information households with less than 168900 in Adjusted Gross Income are eligible.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. Laws Regulations. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

Nassau County Law Enforcement. New York States property tax cap. The 2021 tax year exemption applications will be available in early March.

Applicants should be the person. Current tax represents the amount the present owner pays including exemptions or reductions. 338200 7806.

75 x 72 mills 540 in City Taxes Due. Notice that we use old 2020 tax rates. If the taxable value of a property is 75000 and the taxing authoritys millage rate is 72 mills then the taxes due would be calculated as follows.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. 378000 10293. Who should fill out the application.

Taxable Property Value of 75000 1000 75. Cities Towns. Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Once this exemption is applied the Assessors Office automatically renews it for you each year. How Is My Property Tax Determined. Deputy County Executive.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Tax description Assessed value Tax rate Tax amount. Households with Adjusted Gross Income of 168901 - 500000 with proof of eligible economic harm are also eligible.

Moving to Nassau County. Current tax represents the amount the present owner pays including exemptions or reductions.

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Map Bay Area Property Taxes Kron4

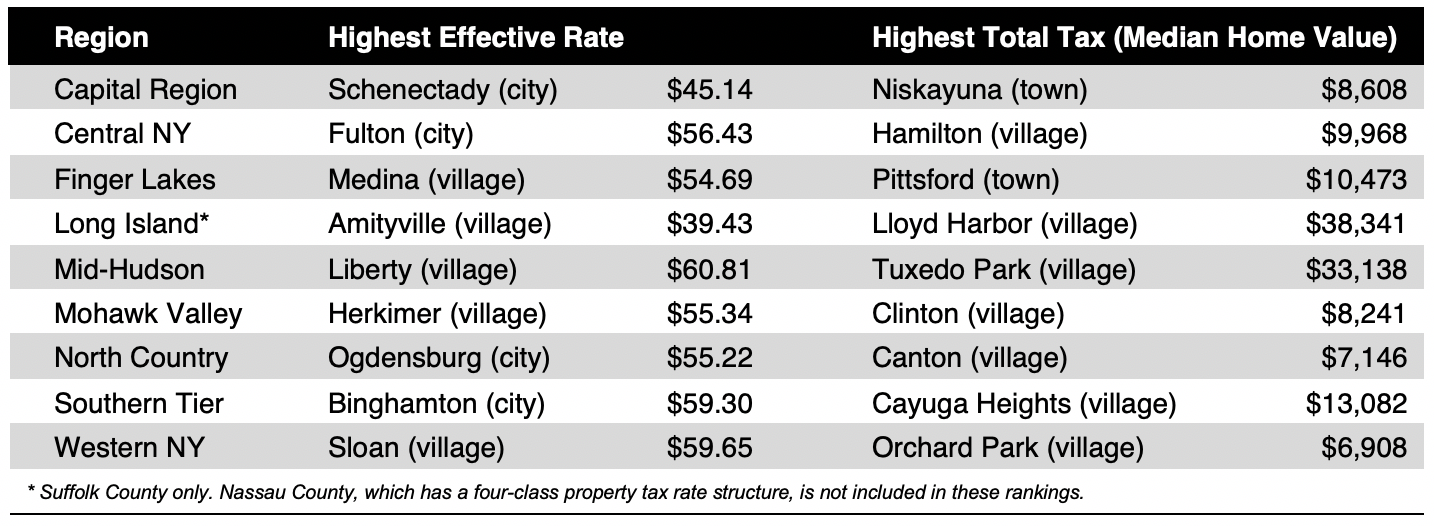

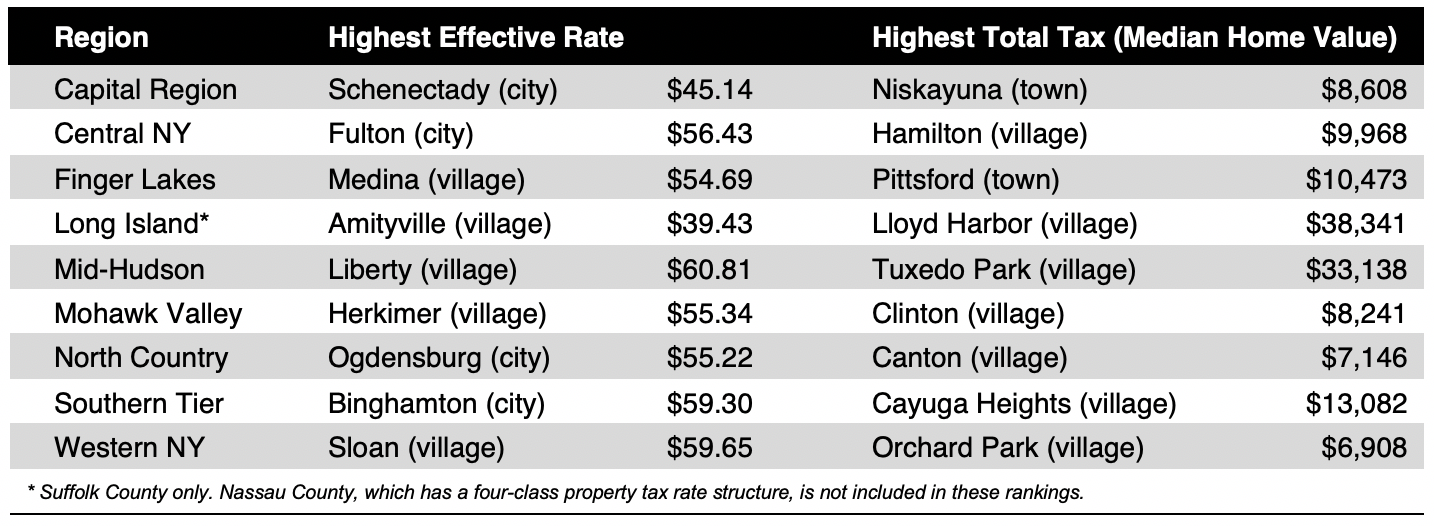

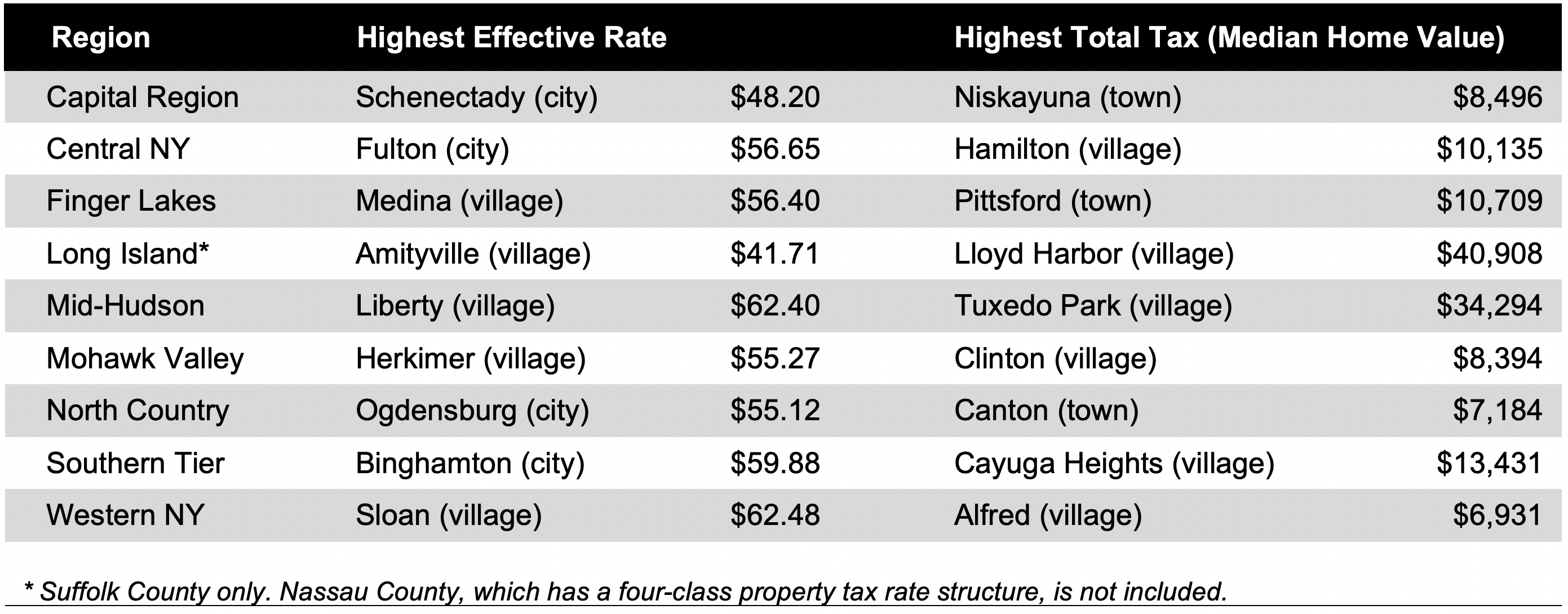

Compare Your Property Taxes Empire Center For Public Policy

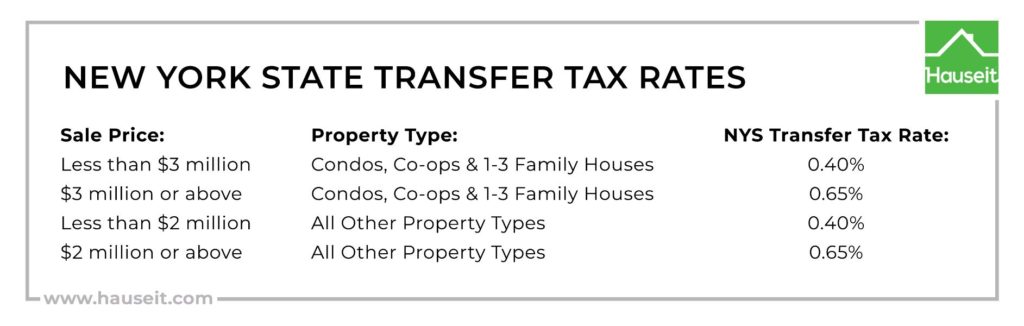

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

New York Property Tax Calculator 2020 Empire Center For Public Policy

Mortgage Rates Drifted Higher On Optimistic Economic News Mortgage Rates Lowest Mortgage Rates Bankrate Com

Make Sure That Nassau County S Data On Your Property Agrees With Reality